*This loan entry goes to assets because cash is expected to be received into the bank.In consignment, the status of consignee is that of a commission agent. The loan journal entry in best boots is:ĭebit: Designer Doors Loan Receivable ( asset * account ) Credit : Bank (asset account ) Intercompany Everyday Expensesīest Boots buys an office printer for Designer Doors for $220.00. These are purely fictional names not based on any real business that I know about.

.png)

car loan journal entryĪ car is an asset so the journal entry for it will be similar for the purchase-via-loan of other assets like workshop equipment.

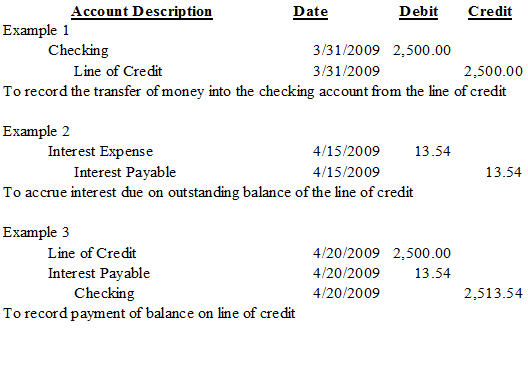

If you use a schedule like this, compare it to your loan account each month to ensure it is tracking as expected. bank loan received journal entryĭebit: Bank Account (asset account ) Credit : Loan ( liability account ) This is usually the easiest loan journal entry to record because it is simply receiving cash, then later adding in the monthly interest and making a regular repayment. bank loan Received journal entryīank loans enable a business to get an injection of cash into the business. The account categories are found in the chart of accounts.ĭepending on the type of ledger account the bookkeeping journal will increase or decrease the total value of each account category using the debit or credit process.

#DUE TO DUE FROM JOURNAL ENTRY MANUAL#

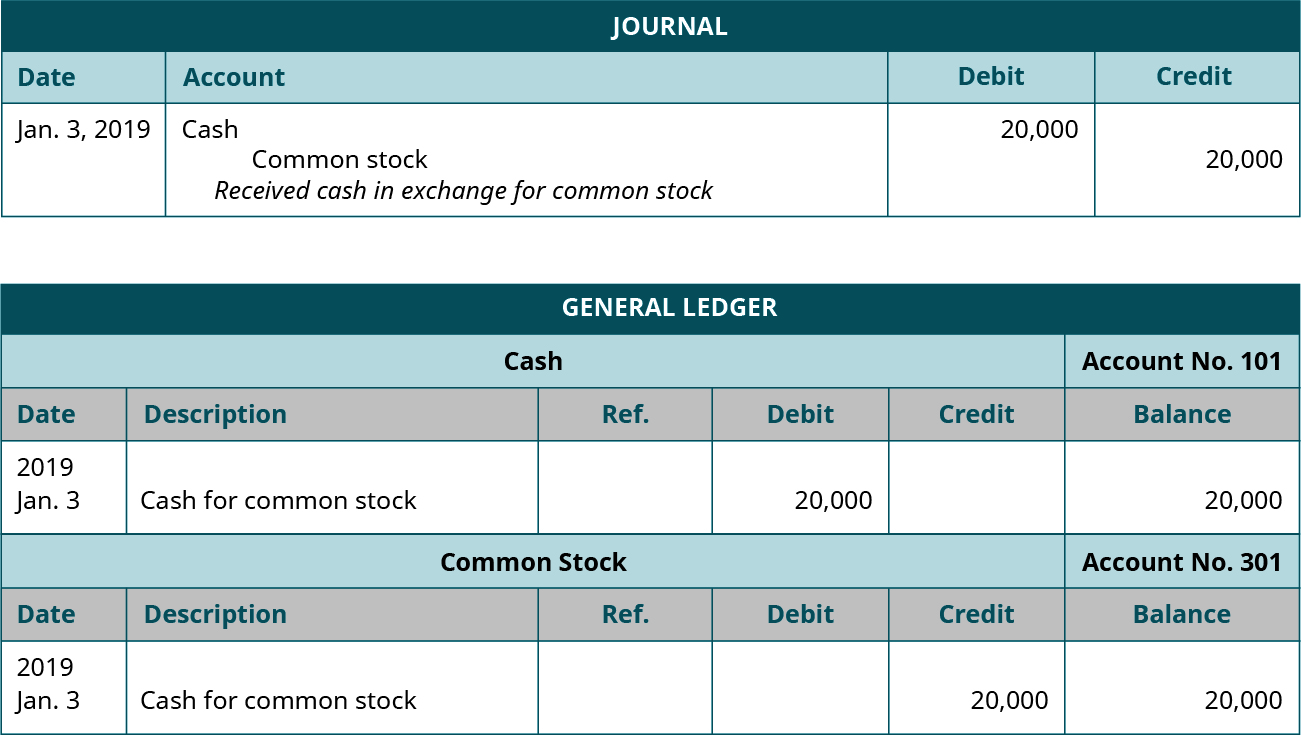

The examples on this page are for both automatic journals involving the bank account and for manual entering of journals.Įvery loan journal entry adjusts the value of a few account categories on the general ledger.

#DUE TO DUE FROM JOURNAL ENTRY SOFTWARE#

When you use bookkeeping software you don't usually see the automatic journal entries that happen in the "background" when reconciling your bank accounts.Įntering a manual journal is handy for adjusting your books without affecting the bank accounts, like when you need to move a transaction from one account category to another like with the loan forgiveness.

0 kommentar(er)

0 kommentar(er)